What Does A Social Security Disability Award Letter Look Like?

Updated July 8, 2025

I get asked this question a lot, but due to strict privacy laws, I’m not allowed to share a real one—even with personal details removed. I also searched for a publicly available template but couldn’t find one.

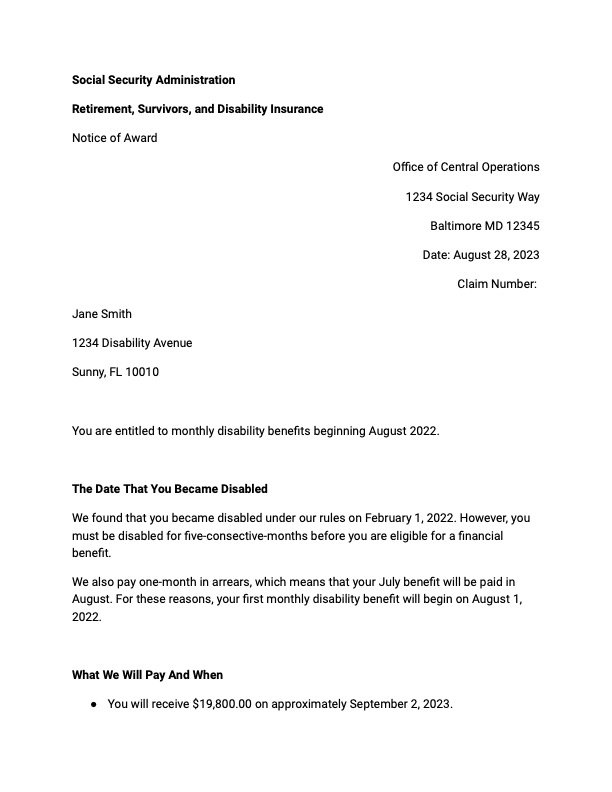

So, I created a sample award letter to help fill that gap. This example is designed to give you a general idea of what a typical SSD award letter looks like. I’ll walk you through each section so you can better understand your own letter and know what to look for—especially when checking for errors.

Please note: This is not an official SSA document. I was not granted permission to use the SSA’s logo, so the federal emblem does not appear on my sample document. This sample is for educational purposes only.

Keep reading to explore the example and learn how to read your Social Security award letter like a pro.

Click here if you would like to review the entire document.

Along with your Social Security Disability award letter, you will also receive the following publications. Please click the links below to learn more:

Before we get into the details, here are a few things to keep in mind:

If you had a hearing, you will receive the Administrative Law Judge’s (ALJ) decision by mail before your Social Security award letter arrives. This decision will also be sent to your local SSA Field Office (FO). The FO will calculate your benefits based on the ALJ’s decision. You might receive a call from the FO to confirm details for the calculation, so be sure to answer calls from unknown numbers—because it could be from the SSA. Not answering calls from the SSA will delay your payments.

When you applied for disability benefits, you were asked to provide your banking information for direct deposit. To avoid any delays in receiving your payments, it’s important to double-check that the information you provided is accurate. If you need to make changes, you can easily update your banking details by logging into your my Social Security account. I’ve included a link at the end of this post to help you set up or access your account.

Typically you’ll receive your direct deposit before the Social Security disability award letter arrives in the mail, since electronic payments are faster are faster than snail mail. So keep an eye on both your bank account and mailbox for the good news!

Now that you know what to expect with your award letter, let’s dive into the details and what it all means for you.

Social Security Disability Award Letter Date

The Social Security disability award letter date is listed below SSA’s contact information. This date is important because you have 60 days (plus 5 days for mailing) to appeal any part of the award letter that you disagree with.

Date of Entitlement (DOE)

The first sentence of the Social Security disability award letter includes your Date of Entitlement (DOE). This is the date SSA determined that you became eligible for disability payments.

Let’s take a step back here. Up until now, your application focused on your Alleged Onset Date (AOD), which is the date you claimed that your disability began. SSA may have determined that your disability began after the date that you alleged, adjusting it based on evidence in your records like MRI results, PET scans, blood work, or when your earnings dropped below Substantial Gainful Activity (SGA). If SSA changed your AOD, they should have explained the reason for the change in their decision.

I briefly mentioned the five-month waiting period on the sample Social Security Disability Award Letter, but let’s dive a little deeper.

If you were awarded SSI (Title XVI): There is NOT a five-month waiting period for financial benefits. You are eligible for financial benefits on the date you were approved.

If you were awarded SSDI (Title II): There is a mandatory five-month waiting period from your AOD before you’re eligible for financial benefits. This means your DOE will be five months after your AOD.

Now that we’ve covered the terms DOE and AOD, we can move on to how SSA calculates and pays your benefits.

Payment Dates

Some of you will have to wait five months, but everyone will have to wait at least one month. SSA has a habit of making people wait!

SSA pays disability benefits in arrears, meaning you receive payment for a given month the following month. For example, if you were eligible for a payment in August, you’ll receive that payment in September.

I’ve worked in the disability industry for over twenty years, and I still count the months on my fingers and toes to triple-check myself! To make all of these new terms clear, I’ll walk you through some examples.

SSI Payments

Pre-Effectuation Review Conference (PERC)

A PERC is a mandatory phone interview conducted by the SSA after an individual is approved for SSI but before payments begin. The purpose of the PERC is to verify that the applicant still meets the financial eligibility requirements for SSI, which is a needs-based program. During the interview, an SSA representative will ask about your income, resources, living arrangements, and any changes since your original application. It's important to be prepared with accurate financial information and documentation, as your answers will determine your final benefit amount and whether you qualify for immediate or installment backpay. Failure to complete the PERC can delay or even prevent your SSI payments from starting.

To learn more, please click here to read our SSI factsheet.

Example One

If you applied for SSI on 02/01/2025 and SSA determined you met the criteria based on an MRI dated 03/01/2025, your DOE would be 03/01/2025. Your March benefit would be paid in April. As of July 2025, you’d be eligible for four months of backpay. If you were eligible for the maximum SSI payment in 2025, you would multiply four months by $967, for a total of $3,868.

Example Two

If you applied for SSI on 02/01/2024 and SSA determined you met the criteria on the date that you applied, your AOD and DOE would be 02/01/2024. Your February benefit would be paid in March. As of July 2025, you’d be eligible for sixteen months of backpay. If you were eligible for the maximum SSI payment in 2025, you would multiply sixteen months by $967, for a total of $15,472.

SSI Backpay Rules

Due to strict SSI resource limits, if you're owed a large retroactive (backpay) payment, SSA is required to divide it into three separate installments, paid out every six months.

The first two payments will be equal to three times the maximum monthly SSI benefit.

The final payment will include the remaining balance.

This rule is designed to prevent your backpay from pushing you over the resource limit, which could result in losing your monthly SSI benefits.

However, if you have a dire financial need, you may request additional funds sooner. Acceptable reasons include:

Medically necessary services, supplies, or equipment

Housing instability or risk of eviction

The need to purchase a vehicle

Past-due bills

You must request this during your financial interview. If you don’t, you’ll automatically be placed on the standard installment plan.

Are you already on the installment plan and now facing urgent needs? Call SSA and request an advance. Be prepared to clearly explain why the additional funds are necessary.

SSDI Payments

Example One

If you claimed you became disabled on 02/01/2022 and SSA determined you met the criteria based on an MRI dated 01/01/2023, your AOD would be 01/01/2023 and your DOE would be 06/01/2023. Your June benefit would be paid in July. As of July 2025, you would be eligible for 24 months of backpay. To estimate your total backpay, multiply your monthly benefit amount by 24.

Example Two

If you claimed you became disabled on 02/01/2022 and SSA agreed with that date, your AOD would be 02/01/2022 and your DOE would be 07/01/2022. Your July benefit would be paid in August. As of July 2025, you’d be eligible for 36 months of backpay. To estimate your total backpay, multiply your monthly benefit amount by 36.

Additional Notes About SSDI

SSA will only conduct a PERC interview if you were approved for both SSI and SSDI, otherwise known as a concurrent claim. If you were only approved for SSDI—SSA will not need to conduct a PERC interview.

SSDI does not have income or asset limits, so you will receive your backpay in one lump-sum.

Benefit Payment Dates

SSI Benefit Payment Dates

SSI payments are typically issued on the first day of each month. If the first falls on a weekend or federal holiday, the payment is made on the business day before. For example, if the first is a Saturday, the payment will arrive on Friday of the previous month.

Source: SSA

SSDI Benefit Payment Dates

The day you receive your monthly SSDI benefit is tied to the day that you were born. Here's how the payment schedule generally works:

If you were born on the 1st through 10th of the month: You will be paid on the second Wednesday of the month.

If you were born on the 11th through 20th of the month: You will be paid on the third Wednesday of the month.

If you were born after the 20th of the month: You will be paid on the fourth Wednesday of the month.

Source: SSA

Auxiliary Benefits

If you do not have dependent children, feel free to skip to the next section.

It's important to understand that auxiliary benefits are not available with SSI, as SSI is a needs-based program and does not provide benefits to dependents.

Auxiliary benefits are monthly payments available to certain family members of individuals who receive SSDI. These benefits help support the household and replace lost income due to the primary wage earner’s disability. Eligible family members may include a spouse, divorced spouse, minor children, and in some cases, disabled adult children (DAC)—provided they meet specific criteria.

If you have biological or adopted children, you may qualify to receive auxiliary benefits for them, as well as for a spouse who is caring for them. Here's how it works:

Your spouse (or ex-spouse, if the marriage lasted at least 10 years) may qualify if they are caring for your child who is under 16, or if they are 62 or older.

Your unmarried minor children may be eligible up to age 18, or 19 if they are still enrolled in full-time high school.

The amount paid to dependents can be up to 50% of your SSDI benefit, but there is a family maximum limit—typically between 150% and 180% of your full benefit. If the total amount exceeds this cap, benefits are reduced proportionally among eligible dependents.

It's important to note that auxiliary benefits are not automatic. You must contact the SSA to apply and provide necessary documentation, such as marriage and birth certificates, to verify eligibility.

Medicare

There are two main types of government-funded health insurance: Medicaid and Medicare.

Medicaid provides coverage for low-income individuals and families.

Medicare is best known as the health insurance program for seniors receiving Social Security retirement benefits.

However, one of the added benefits of receiving SSDI is that you also become eligible for MediCARE—but not right away. Medicare coverage begins 24 months after your Date of Entitlement (DOE) for SSDI.

Let’s revisit an earlier example:

If you claimed you became disabled on 02/01/2022 and SSA agreed with that date, your AOD would be 02/01/2022 and your DOE would be 07/01/2022, then your:

Alleged Onset Date (AOD) would be 02/01/2022

Date of Entitlement (DOE) would be 07/01/2022, following the required five-month waiting period

Because Medicare eligibility begins 24 months after your DOE, your Medicare coverage would start on 07/01/2025.

Recommendation: When it’s time to enroll, please consider working with a Medicare expert. Many SSDI recipients end up overpaying for coverage or choosing the wrong plan due to confusion or fear of making a mistake. A qualified expert can help you avoid unnecessary costs and ensure you get the right coverage based on your needs. Speak with friends and family to receive trusted referrals or search reputable communities online to find a knowledgeable professional. Be careful entering your name and email address into lead generating websites because you do not know if they carefully screen the companies they sell your information to. Those companies may not be licensed, or they may not be reputable. You can never be too careful these days.

Also, be aware that there may be penalties for late enrollment, so it’s important to speak with someone who understands the rules and deadlines to avoid costly mistakes.

Medicaid

If you were awarded SSI benefits, you are automatically eligible for Medicaid in most states. To confirm your coverage, contact your local Department of Children and Family Services (DCFS) or equivalent agency. Many states offer online applications, and you can typically expect a decision within 30 to 45 days.

Due to the recent passage of the Big Beautiful Bill, individuals approved for Social Security Disability should not be subject to Medicaid work requirements. However, I emphasize “should not” because administrative errors may still occur, and some disability beneficiaries may mistakenly be assigned work requirements.

To protect yourself, I strongly recommend that all disability beneficiaries keep an electronic copy of their SSDI or SSI award letter stored safely on their phone, computer, or in a secure cloud folder. This allows you to quickly upload the document if you ever need to prove your disability eligibility to the Medicaid agency in your state.

If you don’t have access to a scanner, you can download scanning app on your smartphone to scan the letter.

For iPhone users:

Open the Notes app

Start a new note

Tap the paperclip icon

Select Scan Documents

Use the Auto mode in the top-right corner

Tap Save when finished

If you do not want to store documents on your phone, email it to yourself and save it in a clearly labeled folder or secure cloud storage. Just make sure it’s somewhere you can access easily and won’t lose access to later.

Having this document ready can save you time, stress, and help correct any Medicaid errors quickly.

You can also access your My Social Security account to download or print a benefit verification letter.

Your Appeal Rights

If you disagree with any part of your Social Security Disability award letter, you have the right to appeal the decision.

You can submit an appeal along with any supporting evidence you believe justifies a correction or adjustment. You must file your appeal within 60 days from the date of the award letter—plus an additional 5 days for mailing. If you miss this 65-day window, you’ll need to demonstrate good cause for the late filing. Examples of good cause include being hospitalized or incapacitated during the appeal period, or if SSA sent the letter to the wrong address and you can provide proof that you did not reside there at the time.

I strongly recommend appealing if there is an obvious error. For example, if the Administrative Law Judge (ALJ) found you disabled as of 03/01/2023, but the award letter incorrectly states your Alleged Onset Date (AOD) as 03/01/2025, this is clearly a typo that needs to be corrected.

Another valid reason to appeal would be an error in your earnings record, which could result in a lower SSDI benefit than you’re entitled to. However, be cautious when appealing an SSI payment amount. Attempting to change your financial responses in hopes of increasing your monthly SSI benefit can backfire unless you have clear and compelling documentation proving the original calculation was incorrect.

If you're unsure, consider speaking with a disability attorney before submitting an appeal.

Conclusion

I apologize for the length of this post. I wanted to address the most common questions regarding Social Security disability award letters I receive. I hope you found this information helpful.

Congratulations on your Social Security Disability approval! Achieving your approval is no small feat, and I'm truly happy for you! If you are seriously considering an appeal, please consult a disability attorney first. A fresh perspective can be invaluable. If they agree with your reasoning, you can confidently move forward. If they advise against it, that’s your sign to let it go.

Resources

If you have questions about how other types of disability benefits work with Social Security Disability benefits, please click here to read my blog post. Read through the pros and cons for the type of disability payments that you receive to determine if your Social Security Disability benefits will be reduced due to additional sources of income or if you can stack the benefits.

If you would like to view the entire Notice of Award example above, please click here.

Do not forget to save this post to your favorites so you can reference this information when your award notice arrives in the mail.

Would you like to share your approval story? We’d love to hear it—drop it in the comments below!